When it comes to choosing a trading platform, the “TrendSpider vs TradingView” debate is one that many traders encounter. Both platforms have risen to prominence in the trading community, each offering a suite of features that promise to enhance market analysis and improve trading outcomes. In this blog post, we’ll dive deep into a comparative analysis of TrendSpider and TradingView, examining various aspects such as user interface, charting tools, automation features, and more to help you decide which platform best suits your trading style. Whether you’re a seasoned trader or just starting out, understanding the nuances of these platforms can empower you to make an informed decision. Let’s explore what each has to offer.

Table of Contents

User Interface and Usability

When it comes to choosing a trading tool, the user interface (UI) and usability are not just about aesthetics; they’re about how efficiently a trader can navigate through charts, indicators, and other analytical tools. This is where a direct comparison between TrendSpider and TradingView becomes critical for traders looking to optimize their workflow.

TrendSpider prides itself on a modern and intuitive interface. It is designed with the user in mind, focusing on automation to reduce the time traders spend on analysis. The platform offers a clean layout with easily accessible menus and a customizable dashboard. One of TrendSpider’s standout features is its automated technical analysis which can be a game-changer for traders who value speed and efficiency. For new users, there might be a slight learning curve due to the unique features it offers, but overall, the platform is user-friendly.

On the other hand, TradingView is known for its robust and highly customizable interface. It caters to both novice and professional traders with its range of charting tools and a flexible workspace that can be tailored to individual needs. The platform’s usability is top-notch, with a focus on community-driven data and easy-to-navigate tabs. TradingView’s charting interface is particularly popular, offering a wide array of technical indicators and drawing tools.

Charting Tools and Technical Indicators

In the realm of technical trading, charting tools and technical indicators are the backbone of any trading decision. A detailed comparison of TrendSpider vs TradingView reveals how each platform equips traders with the necessary tools to analyze market trends and make informed decisions.

TrendSpider is particularly innovative with its charting tools. The platform offers dynamic price charts with automated trendline detection, which can be a significant time-saver. TrendSpider’s algorithms automatically plot support and resistance lines, Fibonacci levels, and other technical patterns, which are crucial for technical analysis. The platform also provides a range of technical indicators, from the classic Moving Averages to the more complex Bollinger Bands and Ichimoku Clouds. The standout feature here is the ability to customize and combine indicators using a feature called Multi-Factor Alerts, which can trigger notifications based on a combination of technical criteria.

TradingView, on the other hand, boasts one of the most extensive collections of charting tools and indicators available on the market. With over 100 pre-built indicators and countless customization options, traders can deeply analyze price action. TradingView’s strength lies in its community-driven indicators, where users can share and access custom indicators created by other traders. This feature not only fosters a collaborative environment but also introduces traders to a wide variety of analytical methods.

Automation Features

In the competitive landscape of financial markets, automation features are a key differentiator for trading platforms. When evaluating TrendSpider vs TradingView, it’s evident that both platforms offer unique automation capabilities designed to streamline the trading process.

TrendSpider takes automation to the next level with features that cater to both novice and experienced traders. Its most notable automation tool is the Market Scanner, which allows users to scan the market for specific conditions and setups across multiple timeframes and instruments. Additionally, TrendSpider’s automated trendline and pattern recognition tools can automatically identify and draw technical patterns on charts, which is a boon for traders who rely on technical analysis. The platform also offers automated alerts that can notify traders of market conditions or indicator crossovers, enabling them to act swiftly on potential trading opportunities.

TradingView, while not as heavily focused on automation as TrendSpider, still offers a range of automated features. Its Pine Script language allows users to create custom scripts and indicators, which can automate analysis and even execute trades through connected brokers. TradingView’s alert system is also robust, providing notifications for price levels, indicator values, or specific technical conditions.

Market Coverage

When traders evaluate “TrendSpider vs TradingView” for their market analysis needs, one crucial aspect to consider is the breadth and depth of market coverage each platform provides. Market coverage refers to the range of financial instruments and exchanges a trading platform can access and provide data for, including stocks, forex, cryptocurrencies, and more.

TrendSpider has made significant strides in market coverage, offering real-time data for a wide array of U.S. stocks, ETFs, forex pairs, and a substantial number of cryptocurrencies. It’s particularly noted for its comprehensive coverage of U.S. equities, which is a major draw for traders focusing on these markets. TrendSpider is also expanding its global reach, providing data from several international exchanges, which is a boon for traders looking to diversify their portfolios across different geographies.

TradingView, on the other hand, is renowned for its extensive market coverage. It supports a vast number of exchanges across the globe and provides data for a wide range of instruments, including stocks, forex, futures, bonds, and cryptocurrencies. This global reach is one of TradingView’s strongest selling points, appealing to traders and investors who require access to a diverse set of markets and asset classes.

Data Accuracy and Speed

In the face-off between TrendSpider and TradingView, data accuracy and speed are pivotal factors that can significantly impact trading decisions and outcomes. Traders require up-to-the-minute information and the assurance that the data they are basing their decisions on is precise and delivered without delay.

TrendSpider is committed to providing data accuracy through its high-quality data feeds. The platform ensures that the price data for stocks, forex, and cryptocurrencies is sourced from reliable and reputable exchanges. TrendSpider’s data is consolidated from multiple sources, providing a comprehensive view that can enhance the decision-making process. The platform also emphasizes speed, with a cloud-based infrastructure designed to deliver real-time data efficiently to its users.

TradingView excels in data speed, offering real-time data across its wide range of supported markets. The platform is known for its robust performance, even when streaming complex charts and indicators that can tax system resources. TradingView’s data accuracy is also top-notch, with feeds coming directly from exchanges and updated in real-time. This ensures that traders have access to the latest market movements as they happen.

Community and Social Features

When comparing TrendSpider vs TradingView, the community and social features of each platform are vital components that can enrich the trading experience. These features allow traders to exchange ideas, strategies, and insights, which can be particularly beneficial for those looking to expand their knowledge and connect with like-minded individuals.

TrendSpider has been developing its community features, offering users the ability to share their analysis and charts with peers. While it may not have as large a community as some competitors, it provides quality interactions and the opportunity for traders to learn from each other. The platform’s focus on automated analysis also encourages a community of traders who value efficiency and technological innovation.

TradingView, in contrast, boasts a vast and active social community. It is one of the platform’s standout features, with millions of users sharing ideas, publishing trading scripts, and providing feedback on others’ analyses. The social aspect of TradingView is deeply integrated into the user experience, with features like live chat, social media sharing, and a ‘like’ system for popular posts. This vibrant community is not just a place for discussion but also a resource for educational content and crowd-sourced information.

Mobile App and Accessibility

In the digital age, the accessibility of trading platforms through mobile apps is not just a convenience but a necessity for traders who need to make decisions on the go. The “TrendSpider vs TradingView” debate extends into how each platform performs in terms of mobile accessibility and the functionality of their respective apps.

TrendSpider has worked to ensure that its mobile app mirrors the efficiency and functionality of its desktop counterpart. The app is designed to provide a seamless experience, with real-time data and alerts, and the ability to conduct detailed technical analysis. Although the mobile version is robust, some users may find that the advanced features of TrendSpider are more suited to a desktop environment due to the complexity of the tools.

TradingView offers a mobile app that is highly rated for its user-friendly interface and comprehensive feature set. It allows traders to access real-time data, customize charts, and even trade directly from the app if their broker is supported. TradingView’s app is particularly noted for its smooth performance and the ability to sync with the desktop version, ensuring that traders can switch between devices without losing their work or settings.

Pricing and Subscription Models

For traders deciding between TrendSpider and TradingView, understanding the pricing and subscription models of each platform is crucial. It’s not just about the cost, but also about what features, data, and services you’re getting for your investment. Let’s delve into how these two platforms compare in this regard.

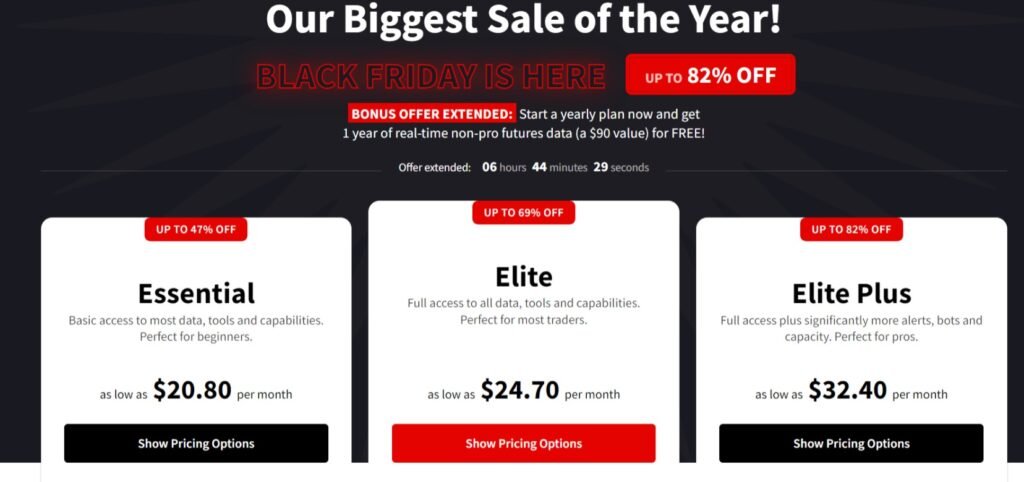

TrendSpider offers a tiered subscription model, which includes different levels of service to accommodate the needs of casual traders to professionals. The pricing structure is straightforward, with each tier offering more advanced features, such as increased alert limits, more extensive historical data, and additional automation capabilities. TrendSpider often promotes annual plans that provide a discount compared to monthly billing, making it a more attractive option for long-term users.

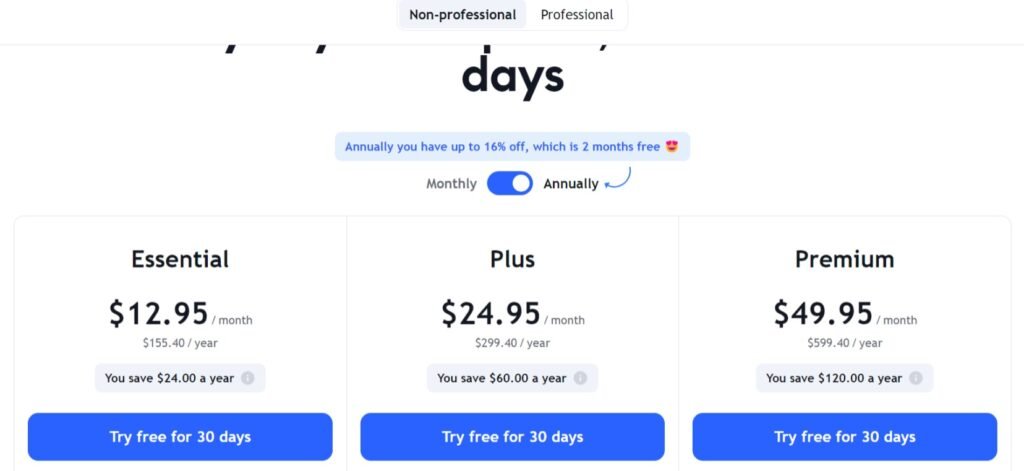

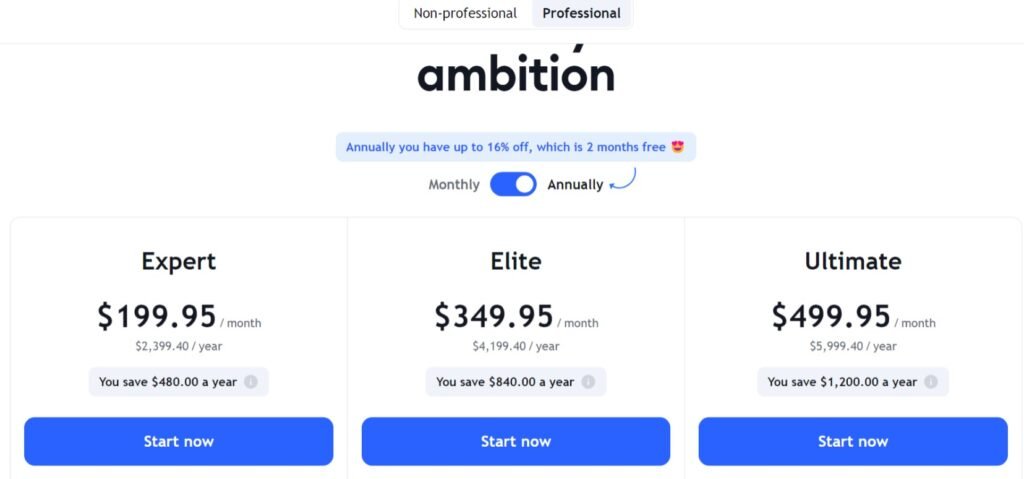

TradingView, known for its flexible pricing, also provides various subscription options, ranging from a basic free plan with limited features to premium offerings that include extensive tools and functionalities. The premium tiers offer additional benefits like more indicators per chart, priority customer support, and an ad-free experience. TradingView’s free plan is a strong draw for beginners who want to test the waters before committing financially.

Customer Support and Resources

When traders are weighing up “TrendSpider vs TradingView,” the level of customer support and the quality of educational resources provided can be a deciding factor. Effective support can enhance the user experience, particularly when navigating complex platforms or resolving technical issues.

TrendSpider takes customer support seriously, offering several avenues for users to get help. This includes live chat support, email, and a comprehensive knowledge base filled with helpful articles and video tutorials. The platform also conducts regular webinars and has a community forum where users can ask questions and share insights. The dedication to educating users is evident, with resources aimed at both beginners and advanced traders.

TradingView also offers robust customer support, with the added benefit of a large, active community where users can often find immediate answers from other experienced traders. The platform provides support through email and has an extensive FAQ section. Additionally, TradingView’s educational content is vast, including trading ideas, a scripting library for custom indicators, and user-generated content that serves as a learning tool.

Integrations and Add-Ons

For traders who rely on a suite of tools to inform their strategy, the integrations and add-ons a platform supports can be a deal-breaker. In the “TrendSpider vs TradingView” comparison, we’ll explore how each platform accommodates additional tools and services to enhance the trading experience.

TrendSpider is designed with integration in mind, offering users the ability to connect with several brokerage platforms. This allows for a streamlined process where traders can analyze and execute trades within the same ecosystem. Additionally, TrendSpider provides various add-ons, particularly in the form of advanced charting tools and automated analysis features, which can be integrated directly into the user’s workflow. The platform’s API access for certain subscription tiers also enables custom integrations, catering to more tech-savvy traders who wish to build their own automated systems.

TradingView stands out for its extensive range of integrations and add-ons. The platform supports direct trading through numerous brokerage accounts, making it incredibly versatile for traders who wish to use TradingView’s charting and analysis tools in conjunction with their existing trading accounts. Furthermore, TradingView’s open-source Pine Script language allows users to create custom indicators and strategies, which can then be shared with the community. The platform’s marketplace also offers a variety of third-party tools and add-ons that can be easily integrated to extend functionality.

Security and Reliability

In the digital trading space, the security and reliability of a platform are paramount. Traders need to trust that their data is protected and that the platform will be operational when they need it most. The “TrendSpider vs TradingView” comparison is not just about features and usability, but also about how each platform ensures the safety and consistency of its service.

TrendSpider takes security seriously, employing advanced encryption methods to protect user data and transactions. The platform operates on a secure cloud infrastructure, which provides not only robust security measures but also redundancy to ensure service continuity. Reliability is further enhanced by regular updates and maintenance schedules that aim to improve performance and prevent downtime.

TradingView also prioritizes security, with a strong track record of protecting its users’ information and maintaining operational integrity. The platform uses industry-standard encryption and has implemented several layers of security to safeguard user accounts. In terms of reliability, TradingView boasts a high uptime percentage, ensuring that traders have access to the platform whenever the markets are open.

Pros and Cons Summary

When traders are faced with the decision of choosing a trading platform, a pros and cons summary can be a highly effective tool. In the context of “TrendSpider vs TradingView,” each platform has its own set of advantages and limitations that cater to different trading styles and preferences. Below is a concise summary that outlines the key pros and cons of each platform.

TrendSpider Pros:

- Automated Technical Analysis: TrendSpider’s automated charting tools and technical analysis save time and provide objective insights.

- Market Scanner: The platform’s market scanner allows traders to quickly identify trading opportunities across various instruments.

- Customizable Alerts: Users can set up multi-factor alerts based on a combination of technical criteria.

- Secure Cloud Infrastructure: Ensures data protection and platform reliability.

TrendSpider Cons:

- Learning Curve: The advanced features may require a learning period for new users.

- Limited Free Version: The free version is quite limited, pushing users towards a paid subscription.

- Focused Market Coverage: While expanding, the market coverage is still more U.S.-centric.

TradingView Pros:

- Extensive Community and Social Features: TradingView’s large community provides a wealth of shared knowledge and user-generated content.

- Wide Market Coverage: Offers a broad range of global financial markets and instruments.

- Robust Mobile App: The mobile app is highly functional and syncs seamlessly with the desktop version.

- Free Plan Availability: There’s a comprehensive free plan suitable for beginners or those testing the platform.

TradingView Cons:

- Complexity of Advanced Features: Some users may find the advanced features and custom scripting options overwhelming.

- Occasional Overload: Due to its popularity, the platform can experience slowdowns during peak market hours.

Conclusion and Recommendations

Deciding between TrendSpider and TradingView is a significant choice that hinges on individual trading styles, needs, and preferences. Both platforms offer robust features that can cater to a range of traders, from the technically savvy who revel in automation to the community-focused individuals who thrive on shared knowledge and collaboration.

TrendSpider is a powerful contender for traders who prioritize automated technical analysis and efficiency. Its advanced charting tools, comprehensive market scanner, and customizable alerts make it a strong ally for those who want to leverage technology to gain an edge in the markets. However, it’s important to consider the learning curve associated with its advanced features and the more limited free version.

TradingView, with its extensive market coverage and vibrant community, is an excellent choice for traders who seek a broad perspective and enjoy engaging with other market participants. The platform’s free plan is a great starting point for beginners, and its advanced features are a boon for experienced traders who need depth and customization.

For those still undecided, here are some recommendations:

- New Traders: TradingView’s free plan and educational community content can be incredibly beneficial when you’re just starting out.

- Experienced Traders: If automation and detailed technical analysis are crucial to your strategy, TrendSpider’s advanced features may be more suitable.

- Mobile Traders: If you need to trade on the go, TradingView’s highly-rated mobile app offers a seamless transition from desktop to mobile.

- Budget-Conscious Users: Consider the cost-to-feature ratio of both platforms. TradingView offers a robust free plan, while TrendSpider’s paid plans provide advanced analytical tools.

Ultimately, the best way to determine which platform is right for you is to take advantage of any free trials or versions they offer. Test out each platform’s features, gauge the responsiveness of their customer support, and assess how well they integrate with your trading routine.

In the dynamic world of trading, having the right tools can make all the difference. Whether you choose TrendSpider for its automated prowess or TradingView for its comprehensive approach, ensure that your chosen platform aligns with your trading goals and enhances your decision-making process. Happy trading!