Dive into the essentials of TradingView with this concise guide. Perfect for anyone in the financial market landscape, this post will illuminate how TradingView’s features, from its user-friendly interface to its advanced technical tools, can enhance your trading strategy. Discover the advantages of integrating this platform into your trading routine, whether you’re a beginner or an expert. Get ready to unlock the full potential of TradingView in your trading journey.

Table of Contents

What is TradingView and Why is it Important for Traders?

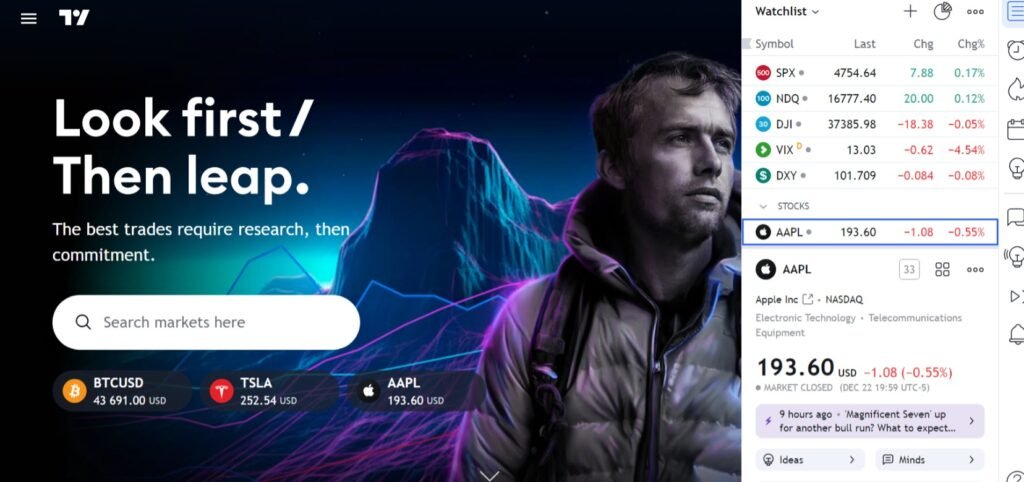

TradingView is a cutting-edge financial platform that provides real-time data, charts, and trading insights for various markets such as stocks, cryptocurrencies, forex, and more. It’s a one-stop solution for traders and investors looking to access advanced charting tools, community-driven insights, and market analysis.

The Problem Facing Modern Traders

In today’s fast-paced financial world, traders, especially beginners, face several challenges:

- Overwhelming Data: The sheer volume of market data can be overwhelming.

- Complex Analysis: Understanding and applying technical analysis is not straightforward.

- Time-Consuming Research: Keeping up with market trends and news requires significant time.

What TradingView Offers

TradingView emerges as a solution to these challenges, providing tools and features that simplify trading:

- User-Friendly Interface: Designed for ease of use, making it accessible even for those new to trading.

- Comprehensive Charting Tools: Offers a range of charting tools to help visualize market trends.

- Real-Time Data and News: Provides up-to-date market data and news, all in one place.

- Community and Social Trading: Access to a community of traders for insights and advice.

Examples of TradingView in Action

Imagine you’re a beginner trader looking at a complex stock chart. TradingView can simplify this by:

- Providing Simple Explanations: Hover over a tool, and get an easy-to-understand description of what it does.

- Customizable Alerts: Set alerts for stock movements, so you’re always in the know without constant monitoring.

- Learning from Others: Follow top traders and see their analysis and trades, offering practical learning.

As someone who has navigated the often intimidating world of trading, I find TradingView to be a game-changer. Its intuitive design demystifies market data, making it easier to understand and act upon. For beginners or those merely curious about trading, it’s a welcoming platform that offers not just tools, but also a community to learn from. It’s like having a trading mentor and a toolkit, all rolled into one accessible package.

How Can You Maximize the Features and Tools of TradingView?

Understanding the Challenge for Traders

New traders often face hurdles like:

- Complex Tools: Figuring out how to use advanced trading tools.

- Strategy Development: Creating effective trading strategies.

- Market Analysis Overload: Managing the flood of market information.

Leveraging TradingView’s Features and Tools

TradingView provides features and tools to tackle these issues:

- User-Friendly Charting Tools: Easy-to-understand charts for market data visualization.

- Variety of Indicators: Tools for analyzing market trends and conditions.

- Strategy Testing Feature: Ability to test trading ideas using past market data.

- Community Access: Chat rooms for insights and advice from experienced traders.

Maximizing the Use of TradingView

To get the most out of TradingView:

- Learn About Different Charts: Understand basic charts like line and bar charts.

- Try Simple Indicators: Start with basic indicators like Moving Averages to understand market trends.

- Experiment with Strategies: Use historical data to see how certain trading ideas might have performed.

- Join Community Discussions: Gain insights from other traders’ experiences.

- Keep Up with Market News: Regularly check for the latest financial news and trends.

Practical Example for Beginners

Let’s say you’re interested in the stock market. With TradingView, you can:

- Use a simple line chart to see how the price of a stock has moved over time.

- Apply a basic Moving Average, which shows the average price over a period, to spot general trends.

- Test a basic idea, like buying when the price is above the average and selling when it’s below.

- Ask questions and get tips from experienced traders in community forums.

What is Automated Technical Analysis in TradingView and How Does it Work?

The Challenge for New Traders

Beginners in trading often face these issues:

- Complex Market Analysis: Understanding the stock market can be complex.

- Staying Informed: It’s tough to keep up with constant market changes.

Automated Technical Analysis in TradingView

TradingView simplifies these challenges with an automated analysis feature:

- Easy Analysis: It uses simple rules to analyze market trends.

- Basic Signals: Identifies common signs in the market like price movements and patterns.

- A Starting Point: Remember, this doesn’t include all market factors, so it’s just a first step.

How It Works

Here’s what automated technical analysis does:

- Scans the Market: Looks over market data like stock prices.

- Applies Simple Rules: Uses basic guidelines to spot trends.

- Gives Quick Insights: Offers quick tips like whether it might be a good time to buy or sell.

Practical Example for Beginners

Imagine you’re watching a company’s stock:

- TradingView might show you that the stock price has gone above its average price for the last 50 days, which often means the stock is doing well.

- It could also tell you if the stock is being bought a lot, which might mean it’s getting too popular and could drop in price soon.

How Does TradingView Keep You Updated with Market News and Stock Scanners?

Challenges Faced by Traders

Traders often struggle with:

- Staying Informed: Keeping up with the latest market news is crucial but time-consuming.

- Analyzing Stocks: Deciding which stocks to focus on requires thorough analysis.

TradingView’s Solution

TradingView offers features to tackle these challenges effectively:

- Aggregated Market News: It pulls news from various sources, keeping you informed of the latest market developments.

- Basic Stock Screener: Allows you to scan stocks based on fundamental metrics like price, volume, and more.

- Integration with Charting Tools: The stock screener works seamlessly with TradingView’s charting capabilities, aiding in generating trading ideas.

How TradingView Keeps You Updated

Here’s how the platform helps:

- Consolidated News Feed: Provides a one-stop source for all market news, saving time in searching for information.

- Easy-to-Use Stock Screener: Simplifies the process of filtering stocks based on specific criteria.

- Generating Trade Ideas: Combines news insights with screener results to help form trade ideas.

Practical Example

Suppose you’re interested in technology stocks:

- Check the news feed on TradingView for the latest updates in the tech sector.

- Use the stock screener to filter tech stocks based on your criteria (like price changes).

- Analyze these stocks with TradingView charts to decide on potential trades.

TradingView’s combination of market news and stock scanning tools is incredibly useful. It streamlines the process of staying informed and identifying trading opportunities. For anyone who wants to stay on top of market trends without spending hours on research, TradingView is an invaluable resource.

How to Effectively Use Stock Alerts and Watchlists on TradingView?

Common Challenges for Traders

Traders often encounter these issues:

- Monitoring the Market: Keeping an eye on market movements constantly is difficult.

- Tracking Favorite Stocks: Remembering and tracking specific stocks of interest can be challenging.

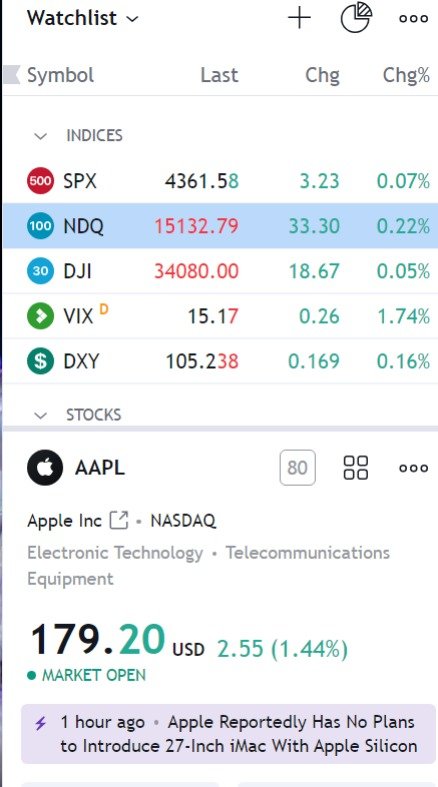

TradingView’s Solutions: Alerts and Watchlists

TradingView addresses these issues with two powerful features:

- Customizable Alerts: Set up alerts for various market conditions, such as price changes or trendline breaks.

- Efficient Watchlists: Create lists to keep track of your favorite stocks and stay organized.

Making the Most of TradingView’s Alerts

To use alerts effectively:

- Set Specific Conditions: For instance, you can set an alert for when a stock reaches a certain price or when a trendline is broken.

- Use for Timely Decisions: These alerts help you make timely trading decisions without having to monitor the market every second.

Utilizing Watchlists

Watchlists can be maximized by:

- Organizing Stocks: Group stocks based on sectors, personal interest, or other criteria.

- Quick Access to Key Information: Use watchlists for fast access to stock performance and news.

Practical Example

Let’s say you’re interested in the energy sector:

- Set alerts for significant price movements in key energy stocks.

- Create a watchlist for energy stocks to keep an eye on their performance and news.

How to Place Orders and Integrate Compatible Brokers with TradingView?

Challenges in Trading and Broker Integration

Traders commonly face these issues:

- Executing Trades: Managing the actual process of buying and selling stocks can be complex.

- Broker Management: Using different platforms for analysis and trading can be inconvenient.

TradingView’s Integrated Trading Solution

TradingView tackles these problems by:

- Broker Integration: Allows linking with various online brokerage accounts for direct trade execution from the platform.

- Simulated Trading: Offers a practice environment for stocks, forex, and crypto to develop and test strategies without financial risk.

Steps to Integrate Brokers and Place Orders

To effectively use this feature:

- Link Your Broker Account: Connect your online brokerage account with TradingView.

- Seamless Trading: Place buy or sell orders directly within the TradingView platform.

- Use Simulated Trading for Practice: Before going live, use the simulated trading feature to practice.

Practical Example

Imagine you have an account with a compatible broker:

- After linking your account, you can directly place trades on TradingView based on your analysis.

- If you’re new, start with simulated trading to get a feel for the market without any financial risk.

TradingView’s integration with brokerage accounts is incredibly efficient. It streamlines the trading process, making it much more convenient and user-friendly, especially for those who are new to trading or prefer having everything in one place. The simulated trading aspect is also a great tool for beginners to practice and build confidence before dealing with real money.

How Customizable are TradingView Charts and How Do You Save Your Layouts?

Common Challenges in Chart Customization

Traders often encounter difficulties like:

- Personalization: Adjusting charts to fit their specific preferences and style.

- Accessibility: Accessing their customized charts across different devices.

TradingView’s Customization and Cloud-Based Solutions

TradingView addresses these needs with:

- High Customizability: Offers extensive customization options including colors, font sizes, and a wide array of indicators.

- Cloud-Based Layout Saving: Allows you to save your chart layouts on the cloud, making them accessible from any device.

Steps for Customizing Charts and Saving Layouts

Here’s how you can personalize your TradingView experience:

- Customize Your Charts: Adjust chart colors, font sizes, and add indicators as per your trading style.

- Save Your Layouts: Once you have your ideal setup, save your layout to the cloud for easy access.

- Access Anywhere: Open your saved layouts on any device, ensuring continuity in your trading analysis.

Practical Example

For example, if you prefer a dark theme for charts:

- Customize the chart background to a dark color, adjust the font size for better readability, and add your favorite indicators like MACD or RSI.

- Save this layout on the cloud.

- Later, access the same layout with all your preferences on your tablet or smartphone.

From my experience, the ability to customize charts on TradingView and save them for cross-device access is a standout feature. It makes the trading analysis not just more personalized but also more convenient. This flexibility is particularly beneficial for traders who use multiple devices or need to switch between different trading environments.

How Does Social Trading Work on TradingView?

Common Challenges in Trading

Traders, especially beginners, often face these obstacles:

- Isolation: Trading can be a solitary activity without much interaction.

- Lack of Ideas: Generating new trading ideas and strategies can be challenging.

TradingView’s Social Trading Feature

TradingView offers a unique solution:

- Social Network Integration: It includes a social platform where users can interact, share, and learn from each other.

- Sharing Trade Ideas: Traders can share their trading strategies and ideas through annotated charts.

Utilizing Social Trading on TradingView

To engage in social trading effectively:

- Join the Community: Become part of TradingView’s social network.

- Share and Learn: Post your own charts with annotations and learn from others’ shared strategies.

- Interact with Traders: Engage in discussions to gain new insights and perspectives.

Practical Example

For instance, if you’re interested in a particular stock:

- You can find charts shared by other traders on this stock, complete with their analysis and predictions.

- Share your own analysis on the stock and receive feedback from the community.

- Engage in discussions to understand different viewpoints and refine your strategy.

TradingView’s social trading aspect is a game-changer. It creates a sense of community and provides a platform for knowledge exchange, which is invaluable, especially for those who are new to trading. This interactive environment not only fosters learning but also helps in broadening one’s trading horizons.

What Does TradingView Cost and Is It Good Value for Money?

Understanding the Cost Concerns of Traders

Traders often wonder about:

- Affordability: Finding a budget-friendly platform with robust features.

- Value for Money: Ensuring the cost of a service aligns with the benefits received.

TradingView’s Pricing and Offerings

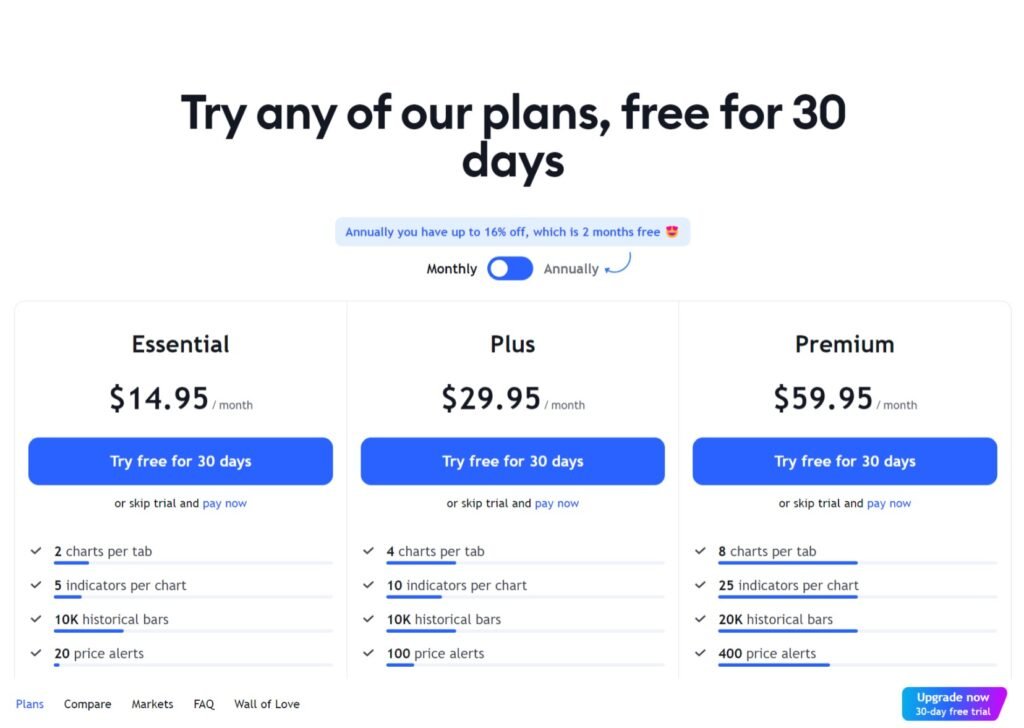

TradingView has structured its pricing to cater to various needs:

- Free Version: Offers powerful tools and basic features without any cost.

- Paid Plans: Range from $14.95 to $59.95 per month.

- Additional Features in Paid Plans: Include real-time data, extended trading hours, and more indicators per chart.

Breaking Down the Value Proposition

Considering the cost versus benefits:

- Free Version: Ideal for beginners or those who need basic charting and analysis tools.

- Paid Plans: Suited for more serious traders who need advanced features like real-time data.

- Technical Analysis Focus: The platform is particularly valuable for those prioritizing technical analysis.

Practical Example

For a technical trader:

- The free version offers enough to get started with basic analysis.

- As needs grow, upgrading to a paid plan provides advanced tools for in-depth market analysis.

From my perspective, TradingView offers excellent value for money. Its free version is remarkably comprehensive for no cost, and the paid plans are reasonably priced considering the advanced features they offer. For anyone serious about technical trading, the investment in a paid plan is likely to pay off in terms of the tools and insights gained.

Conclusion: Is TradingView the Right Tool for Your Trading Needs?

After exploring the various features of TradingView, it’s clear that this platform offers a comprehensive suite of tools for traders of all levels. Whether you’re a beginner needing a user-friendly interface and basic charting tools, or an experienced trader seeking advanced technical analysis and real-time data, TradingView has something to offer.

- For Beginners: Its easy-to-use interface and free version make it an ideal starting point.

- For Advanced Traders: The depth of technical analysis tools and real-time data in the paid versions cater well to more serious trading endeavors.

- Value for Money: With its range of free and reasonably priced plans, TradingView offers a good balance of cost and features.

Ultimately, whether TradingView is the right tool for you depends on your individual trading style and needs. Its ability to cater to a wide range of traders, coupled with its customization options and social trading features, makes it a versatile and valuable platform in the world of trading.

Support and Save with TradingView

Interested in elevating your trading game with TradingView? By signing up through my affiliate link in this blog post, you’re not only getting access to a powerful trading tool but also supporting me in bringing more insightful content to you. Plus, as a token of appreciation, you’ll receive $15 to put toward your new TradingView plan. This helps both of us – you get a discount on a valuable tool, and I receive a commission at no extra cost to you, enabling me to continue sharing great tools and tips. Your support in this journey is immensely appreciated!

Looking for Another Perspective?

If you’re interested in another insightful review of TradingView, check out the detailed analysis provided by Wall Street Zen. Their TradingView review offers another perspective that might help you further understand the platform’s capabilities and how it can fit into your trading strategy. It’s always beneficial to consider different viewpoints to make the most informed decision!

Exploring More Trading Platforms

While TradingView offers a comprehensive suite of tools for traders, there are other platforms that can further enhance your trading experience. If you’re looking for other Trading platforms in the realm of trading and market analysis, you might find “Trade Ideas” and “EasyMarkets” intriguing.

- Trade Ideas: For innovative market scanning and AI-driven trade suggestions, Trade Ideas offers a unique approach to stock market analysis. It’s designed to empower traders with real-time data and algorithmically generated trading opportunities.

- EasyMarkets: If you’re venturing into Forex or looking for a user-friendly trading platform, EasyMarkets provides an accessible and feature-rich environment for both new and experienced traders. Its intuitive interface and versatile trading options make it a noteworthy choice.

Exploring these platforms can provide you with additional perspectives and tools to refine your trading strategies.

Pingback: Vestinda Review: My Honest Trading Platform Discovery for 2024 - Finance Mastery Guide