If you’re considering diving into the world of online trading, easyMarkets is a platform that may have caught your attention. In this comprehensive review, we’ll take an in-depth look at what easyMarkets has to offer, from its user-friendly interface and range of trading instruments to its robust security measures and dedicated customer support. Whether you’re a seasoned trader or just starting out, understanding the nuances of your chosen trading platform can make a significant difference in your trading journey. Join us as we explore the features, services, and overall trading experience provided by easyMarkets, helping you make an informed decision about whether this platform aligns with your trading goals.

Table of Contents

Regulation and Safety

When it comes to online trading, the importance of choosing a platform that prioritizes regulation and safety cannot be overstated. easyMarkets, a well-established broker in the financial markets, understands this necessity and has taken robust measures to ensure its clients trade with confidence.

Regulatory Compliance

easyMarkets operates under the oversight of multiple regulatory bodies across various jurisdictions. The platform is licensed by the Cyprus Securities and Exchange Commission (CySEC) and the Australian Securities and Investments Commission (ASIC), two of the most reputable financial regulatory agencies globally. These regulators ensure that easyMarkets adheres to strict financial standards and operates with transparency.

For traders, this means that easyMarkets is accountable to authorities that enforce investor protection and ethical financial practices. The regulatory framework compels the broker to maintain the highest standards of corporate governance, financial reporting, and disclosure.

Client Fund Safety

Client fund security is a cornerstone of the easyMarkets safety protocol. The platform ensures that all client funds are segregated from its own operational funds, meaning that traders’ money is kept in separate bank accounts. This is crucial because it protects clients’ funds in the unlikely event that the company faces financial difficulties.

Moreover, easyMarkets participates in an investor compensation fund, which serves as an additional layer of protection for clients’ capital. This fund can cover eligible investors in the case of the broker’s insolvency.

Secure Trading Environment

easyMarkets employs advanced security measures to safeguard its trading environment. The use of SSL (Secure Socket Layer) technology ensures that all data transmission is encrypted, protecting sensitive client information from unauthorized access. Additionally, the platform has robust firewalls and secure transaction processing protocols to prevent any security breaches.

Account Types

Choosing the right account type is a critical step for any trader, and easyMarkets offers a variety of account options to cater to the needs of different traders. Whether you are new to trading or have years of experience, easyMarkets provides tailored account types that can help you manage your investments effectively.

Understanding Your Options

easyMarkets has designed its account types to be straightforward and transparent, making it easier for traders to select the one that best fits their trading style and goals. Here’s a brief overview of the account types available on easyMarkets:

- Demo Account: Ideal for beginners, the demo account allows traders to practice trading with virtual money and familiarize themselves with the easyMarkets platform without any risk.

- Standard Account: This account type is suited for those who are ready to dive into live trading. It offers competitive spreads and full access to all of the trading instruments available on easyMarkets.

- VIP Account: For more experienced traders, the VIP account provides tighter spreads and additional features such as a personal account manager and free trading signals.

- Premium Account: This is a step up from the Standard Account and is designed for serious traders who will benefit from lower spreads and a higher level of service.

Each account type comes with its own set of features and benefits, such as access to a dedicated account manager, free market updates, and educational resources. Traders can also enjoy features like stop loss and take profit options, which are available across all account types.

Customizing Your Trading Experience

easyMarkets understands that one size does not fit all when it comes to trading. That’s why they offer the flexibility to customize your account according to your trading preferences. You can choose from a range of leverage options and set up your account to reflect your risk tolerance and trading strategy.

Trading Platforms

A reliable trading platform is the backbone of any successful trading experience, and easyMarkets offers robust platforms that cater to the needs of modern traders. With a focus on accessibility and user-friendly interfaces, easyMarkets ensures that its clients can trade efficiently and effectively.

easyMarkets Platform

The proprietary easyMarkets platform is designed with simplicity and functionality in mind. It is web-based, meaning that traders can access it from any computer without the need to download or install any software. The platform’s intuitive design makes it easy for beginners to navigate while still offering advanced features that experienced traders look for.

Key features of the easyMarkets platform include:

- DealCancellation: This unique feature allows traders to undo a trade within a specified time after execution, offering a safety net in volatile markets.

- Freeze Rate: Traders can pause a rate momentarily to make a decision during fast-moving market conditions.

- Fixed Spreads: Ensuring cost transparency and protection from market gaps.

MetaTrader 4

For those who prefer a more widely recognized platform, easyMarkets also provides access to MetaTrader 4 (MT4), one of the most popular trading platforms in the world. MT4 is known for its analytical capabilities, customizable charts, and the ability to use automated trading robots (Expert Advisors).

The MT4 platform with easyMarkets allows traders to enjoy:

- Advanced Charting Tools: A multitude of pre-installed technical indicators and graphical objects.

- Expert Advisors: The ability to automate trading strategies.

- Mobile Trading: Access to trading on the go with the MT4 mobile app.

Available Trading Instruments

Diversification is a key strategy in trading, and easyMarkets offers an extensive range of trading instruments to its clients. By providing access to various markets, easyMarkets ensures that traders can spread their investments and manage risks more effectively.

Forex

At the heart of easyMarkets’ offerings is a comprehensive selection of currency pairs. Traders can access major pairs, which include the most traded currencies worldwide, as well as minors and exotic pairs that may offer greater volatility and potential for profit.

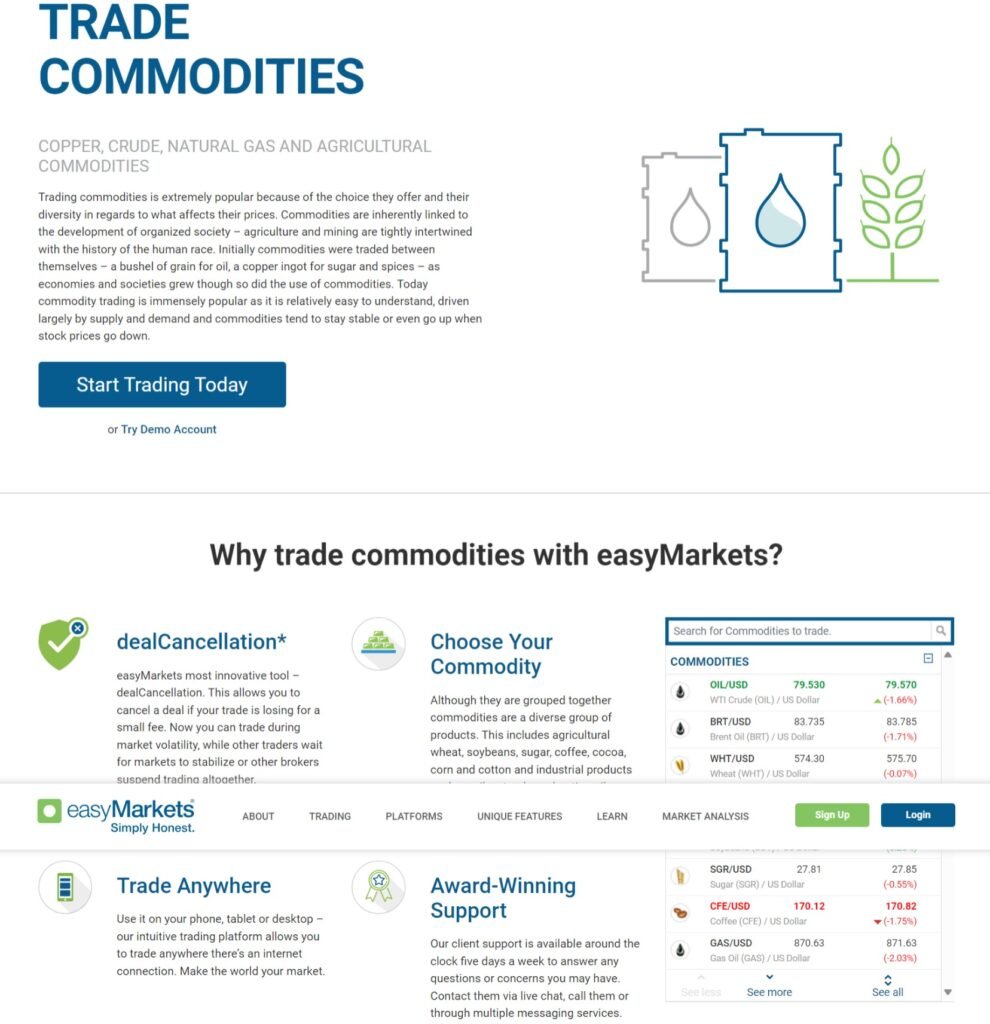

Commodities

For those looking to trade on goods that power the global economy, easyMarkets provides the ability to trade a variety of commodities. This includes precious metals like gold and silver, energy commodities such as oil and gas, and agricultural products like cotton and wheat.

Indices

easyMarkets also offers indices, which allow traders to take positions on the performance of a group of stocks representing a specific market segment or economy. Trading indices can be a powerful way to gain exposure to a broad market with a single transaction.

Cryptocurrencies

In response to the growing demand for digital currency trading, easyMarkets has included a selection of the most popular cryptocurrencies. Traders can speculate on the price movements of digital currencies like Bitcoin and Ethereum, among others.

Shares

For those interested in the equity market, easyMarkets provides the opportunity to trade shares from leading global companies. This allows traders to engage with the market performance of individual firms without having to purchase the underlying asset.

Options

easyMarkets also offers options trading, which gives traders the ability to speculate on the future price of an asset with a fixed risk. This can be a valuable tool for traders looking to h

Spreads, Fees, and Commissions

Understanding the cost of trading is crucial for every trader, and easyMarkets is known for its transparent approach to spreads, fees, and commissions. This clarity ensures that traders can make informed decisions without worrying about hidden charges.

Fixed Spreads

easyMarkets offers fixed spreads, which means that the spread, the difference between the bid and ask price, remains constant regardless of market conditions. This can be particularly advantageous during market volatility, as it provides stability and predictability for the cost of trades. Fixed spreads can help traders to calculate their trading costs upfront, making it easier to manage their trading strategy and budget.

No Commissions

One of the standout features of trading with easyMarkets is that they do not charge commission fees on trades. This policy applies to the majority of the instruments available on the platform, including forex, commodities, and indices. The absence of commission fees simplifies the trading process, as traders only need to consider the spread when entering a trade.

Transparent Fee Structure

easyMarkets prides itself on having no hidden fees. The platform ensures that all potential charges are clearly outlined, so traders are fully aware of any costs associated with their trading activity. This includes fees that may be incurred for services such as overnight funding (also known as rollover or swap fees), which are common in the industry for positions held open overnight.

Leverage and Margin Requirements

Leverage and margin are critical concepts in forex and CFD trading, and easyMarkets offers competitive options to suit various trading strategies and risk appetites. Understanding how these work will help you to maximize your trading potential while managing risk.

Leverage Explained

Leverage is a tool that allows traders to control a large position with a relatively small amount of capital. It is expressed as a ratio, such as 1:30, which means that for every $1 in your account, you can control $30 in the market. easyMarkets provides leverage options that can amplify a trader’s exposure to the markets, potentially increasing the profits on successful trades. However, it’s important to remember that while leverage can magnify returns, it can also increase losses.

Margin Requirements

Margin is the amount of capital required to open and maintain a leveraged position. It is essentially a good-faith deposit that is tied up while a trade is open and is released once the trade is closed. easyMarkets has clear margin requirements that are easy to understand and calculate, allowing traders to make informed decisions about their positions.

Risk Management

easyMarkets emphasizes the importance of risk management when using leverage. The platform offers tools and features to help traders control their risk, such as stop loss orders, which can protect against market volatility. Traders are encouraged to use these tools to manage their exposure and protect their capital.

Unique Features and Tools

easyMarkets sets itself apart from other trading platforms with a suite of unique features and tools designed to enhance the trading experience. These innovative offerings provide traders with greater control over their trades and help manage risk effectively.

DealCancellation

One of the standout features of easyMarkets is DealCancellation. This exclusive tool allows traders to cancel a losing trade within a specific time frame for a small fee. It’s an exceptional safety net that gives traders the power to undo a decision if the market moves against them shortly after opening a position.

Freeze Rate

The Freeze Rate feature is another innovative tool offered by easyMarkets. It enables traders to “freeze” a price they see for a few seconds, allowing them to execute the trade at that exact rate, even in a fast-moving market. This can be particularly useful during periods of high volatility when prices change rapidly.

easyTrade

easyTrade is a feature that simplifies the trading process, allowing traders to set their maximum risk and potential payout before they enter a trade. It combines elements of both binary options and spot trading while offering the potential for high leverage with fixed risk.

Forward Deals

Forward Deals are designed for traders looking to lock in a current price for a future date, protecting against market fluctuations. This tool can be particularly useful for those who have a long-term view of the market or for businesses looking to hedge against currency risk.

Deposits and Withdrawals

Efficient and secure deposits and withdrawals are crucial to a seamless trading experience. easyMarkets offers a straightforward process for funding and withdrawing from your trading account, ensuring that you can manage your finances with ease and confidence.

Making Deposits

Funding your easyMarkets account is a simple and quick process. The platform supports a variety of payment methods, including:

- Credit and debit cards

- Bank wire transfers

- E-wallets like Skrill and Neteller

- Local payment methods depending on your region

Deposits are generally processed instantly, especially when using cards or e-wallets, allowing you to start trading without unnecessary delays. easyMarkets does not charge any fees for deposits, and the platform takes great care to ensure the security of your transactions.

Withdrawing Funds

When it comes to withdrawals, easyMarkets maintains a process that is just as straightforward. Withdrawal requests are processed promptly, typically within 24 hours, though the time it takes for funds to appear in your account will depend on the withdrawal method you choose.

To comply with financial regulations and ensure the security of your funds, easyMarkets follows a strict policy that requires you to withdraw funds to the same source from which you made your deposit.

Account Verification

Before making a withdrawal, you will need to complete the account verification process. This is a standard industry practice designed to protect your account from unauthorized access and to comply with anti-money laundering laws.

Risk Management

Risk management is a critical aspect of successful trading, and easyMarkets provides a range of tools and features to help traders mitigate risks. By understanding and utilizing these tools, traders can protect their investments and navigate the markets more confidently.

Stop Loss and Take Profit

easyMarkets offers essential risk management tools such as stop loss and take profit orders. A stop loss order automatically closes a trade at a predetermined level to prevent further losses if the market moves unfavorably. Conversely, a take profit order locks in profits by closing the trade once the market reaches a favorable level.

Negative Balance Protection

One of the key risk management features provided by easyMarkets is negative balance protection. This ensures that traders cannot lose more money than they have in their trading account, protecting them from any unexpected market movements that could result in a negative balance.

Fixed Spreads

With fixed spreads, easyMarkets traders can predict and calculate their trading costs in advance. Fixed spreads mean no surprises during volatile market conditions, which is crucial for managing financial exposure and implementing precise trading strategies.

Financial Education and Resources

easyMarkets is committed to trader education, offering a wealth of resources to help traders make informed decisions. From market news and analysis to educational guides and webinars, traders have access to information that can enhance their risk management strategies.

Customer Support and Service

In the dynamic world of online trading, having access to reliable customer support can make a significant difference. easyMarkets is known for its exceptional customer support and service, ensuring that traders can get assistance whenever they need it.

Accessibility of Support

easyMarkets provides multiple channels through which traders can reach out for support:

- Live Chat: For immediate assistance, the live chat feature on the easyMarkets website and trading platform offers quick and convenient help.

- Email: Traders can send detailed inquiries and receive thorough, thoughtful responses.

- Phone Support: For those who prefer speaking directly to a support representative, easyMarkets offers phone support with a friendly and knowledgeable team.

Multilingual Support

Understanding the global nature of trading, easyMarkets offers customer support in various languages. This multilingual support ensures that traders around the world can communicate effectively and receive the help they need in a language they’re comfortable with.

Hours of Operation

The customer support team at easyMarkets is available 24/5, aligning with global trading hours. This means that traders can get support at almost any time during the trading week, from market open on Monday to market close on Friday.

Training and Education

Beyond problem-solving, easyMarkets’ customer support also includes access to training and educational resources. New traders can benefit from one-on-one sessions, while experienced traders can get advanced tips and insights.

Community and Market Reputation

A broker’s reputation in the community and market is a testament to its reliability and service quality. easyMarkets has built a strong reputation over the years, reflected in its customer feedback and industry recognition.

Customer Feedback

easyMarkets values the voice of its traders, and customer feedback is a vital part of its reputation. The platform has received positive testimonials for its user-friendly interface, range of trading instruments, and exceptional customer support. Traders often highlight the transparency and ease of use as key factors in their satisfaction.

Industry Awards

The industry has recognized easyMarkets with numerous awards for its innovative technology, customer service, and trading conditions. These accolades are a clear indicator of the broker’s commitment to excellence and innovation in the field of online trading.

Online Community Presence

easyMarkets maintains an active presence in online trading communities and forums. This engagement demonstrates the platform’s commitment to staying connected with its user base and the broader trading community. It also provides a channel for traders to share experiences, tips, and strategies.

Social Proof and Endorsements

Social proof through endorsements from well-known traders and industry experts can also contribute to a broker’s market reputation. easyMarkets has garnered endorsements for its reliable trading environment and commitment to trader education and support.

Conclusion and Final Thoughts

In the competitive landscape of online trading platforms, easyMarkets has distinguished itself as a broker that combines user-friendly technology with a comprehensive range of services. Throughout this review, we’ve explored the various facets of easyMarkets, from its regulatory compliance and safety measures to its diverse account types, robust trading platforms, and extensive array of trading instruments.

We’ve delved into the details of spreads, fees, and commissions, highlighting easyMarkets’ commitment to transparency and cost-effectiveness. The platform’s leverage and margin requirements cater to traders’ diverse risk profiles, while unique features like DealCancellation and Freeze Rate provide innovative ways to manage trades.

The importance of efficient deposit and withdrawal processes has been addressed, showcasing easyMarkets’ efforts to ensure smooth financial transactions for its clients. Moreover, the platform’s dedication to risk management has been evident, offering tools and educational resources to help traders navigate the markets responsibly.

Customer support and service at easyMarkets have proven to be top-notch, with a focus on accessibility, multilingual assistance, and educational support, reflecting a customer-centric approach that values trader success. Additionally, the community and market reputation of easyMarkets speak volumes, with positive feedback from traders and recognition from industry bodies reinforcing the platform’s credibility.

In conclusion, easyMarkets presents itself as a reliable and reputable broker that is well-suited for traders looking for a balanced combination of user-friendly features, comprehensive tools, and a secure trading environment. Whether you are a novice trader or have years of experience, easyMarkets seems to have crafted a service that can meet your trading needs and help you achieve your investment goals.

As with any trading platform, it’s important to conduct your own due diligence and consider your individual trading needs and objectives before getting started. However, based on the aspects covered in this review, easyMarkets is certainly worth considering as a strong contender in your selection of a trading partner.

Remember, trading involves risk and it’s always possible to lose capital. Tools and features like those offered by easyMarkets can help manage this risk, but they can never eliminate it entirely. Trade wisely, and make use of the educational resources available to you.

Pingback: TradingView: Here's My Honest Opinion and Review About it for Your Trading Journey in 2024 - Finance Mastery Guide

Pingback: Choosing the Best Trading Platform Made Easy: 10 Essential Tips for Beginners - Finance Mastery Guide